Why financial literacy — not outrage — is the real inheritance lesson

When a Burlington woman told SooToday that the government “took every cent” of her parents’ estate, her grief and frustration were understandable. Losing both parents within a year — before age 65 — is heartbreaking. But her viral claim that the government “took everything” isn’t just inaccurate. It’s dangerous misinformation.

A Painful Story — and a Misleading One

The article describes how the family faced a $659,000 tax bill after the death of both parents — half from registered savings (RRSPs) and half from capital gains on a family cottage.

Yes, that’s a big number. But it’s not government theft. It’s how our tax system has always worked — one that rewards saving, allows tax-deferred growth, and funds the infrastructure that makes property valuable in the first place.

“Dead people can’t own things.”

That’s the rule — and it’s not new.

When someone dies, their RRSP is treated as if it were fully cashed out on the date of death. The total becomes taxable income for that year. If you have $715,000 in RRSPs, you’ll pay tax like someone earning $715,000 — about 50%. That’s not unfair; that’s deferred income tax.

RRSPs Are Not “Savings” — They’re Deferred Income

RRSPs (or RIFs, LIFs, etc.) aren’t tax-free accounts. They’re tax-deferred accounts. You saved pre-tax income while working, got a refund at the time, and agreed to pay tax later — ideally when your income (and tax rate) would be lower.

The problem? Most people forget that “later” eventually comes.

When both parents died young, that “later” became “now.” The tax bill arrived, not as a punishment, but as the system working exactly as designed.

Quick truth: There is no 100% tax in Canada.

Even with RRSP withdrawals, you always retain a significant portion after taxes.

Capital Gains 101: Paying Tax on Growth, Not Ownership

The family also faced about $300,000 in capital gains tax on their Collingwood-area cottage — a property that appreciated from $600,000 to $1.8 million.

Let’s break it down:

- Capital gain: $1.2 million

- Taxable portion: 50% = $600,000

- Tax owing (approx.): $300,000

That’s about 25% of the total value. Meaning? They still kept 75% of the asset. The family wasn’t robbed. They simply paid the cost of appreciation — the price of a good investment.

The Real Numbers

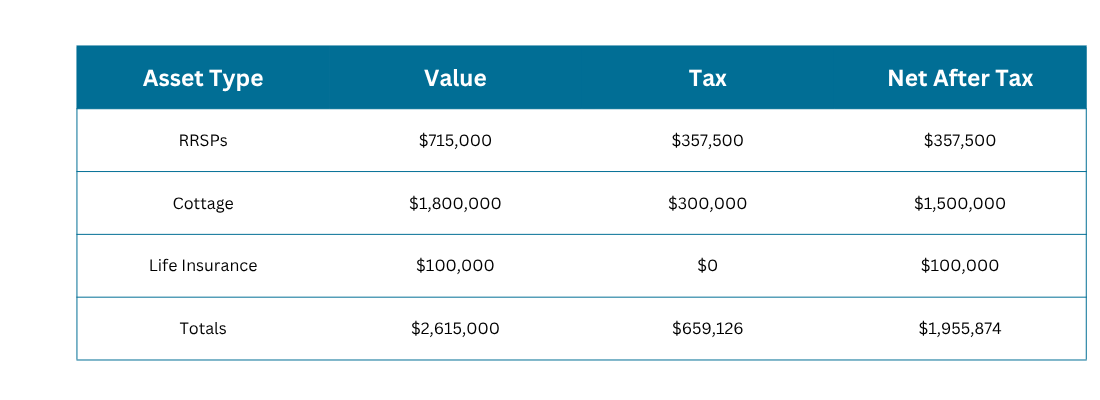

Here’s what this estate looked like:

Divided equally, that’s nearly $978,000 in value per child — most of it tied up in the family cottage after taxes were paid.

To call that “every cent taken” is not only inaccurate — it’s entitlement culture in full bloom.

The Hard Truth About Personal Responsibility

It’s easier to blame “the government” than to face hard truths:

- Maybe the parents didn’t understand how taxes work.

- Maybe they didn’t plan for estate tax.

- Maybe no one had those uncomfortable financial conversations.

That’s not cruelty. That’s reality.

We can’t prevent death — but we can prevent ignorance.

Education, planning, and life insurance can turn a crisis into stability for the next generation.

Quick Truth: “The government didn’t take your inheritance. The lack of planning did.

We Don’t Need Outrage. We Need Education.

Our tax system isn’t perfect — but it’s transparent. It’s also the same one that funds roads, hospitals, pensions, and schools. The same system that protects the property values of the very assets we pass down.

The article’s framing — that the government “took” everything — feeds the wrong narrative.

The truth? Knowledge is your best inheritance.

What Families Can Learn From This

- Understand what you own. RRSPs are income. TFSAs and life insurance are tax-free. Learn the difference.

- Plan ahead. Work with professionals to model your estate, anticipate taxes, and protect assets.

- Communicate. Talk to your family about what happens next — before they have to learn the hard way.

Final Word: Education Is the Best Estate Plan

This story is tragic in its grief but avoidable in its outcome.

If you want your family to keep what you’ve worked for — don’t rely on hope or outrage. Rely on information and action.

Plan Smarter With Brown Lawyers

At Brown Lawyers, we help families turn uncertainty into clarity.

Our team doesn’t just write Wills — we build holistic, values-based estate plans that align with your goals, your loved ones, and your reality.

→ Book your estate planning consultation

Or explore our estate planning insights to get informed, not alarmed.